This article first appeared on WeChat public number: Tiger Fortune. The content of the article belongs to the author's personal opinion and does not represent the position of Hexun.com. Investors should act accordingly, at their own risk.

| Finance · Life · Gossip | Financial Circle Lifestyle Finder

Recently, a group of Chinese companies have once again been attacked by various types of international short-selling forces. For example, China Credit, a listed company on the Hong Kong Stock Exchange, was anonymized and short-selling. The Nasdaq-listed Pingtan fishery was shorted by Aurelius Value, and the stock price may face fluctuation.

Short-selling organizations based on Shannon, Surabaya, Aurelius Value, and Anonymous Analysis have been staring at Chinese overseas listed companies for many years, and have profited from Chinese companies through manufacturing fluctuations. However, these short-selling institutions themselves are unsupervised, short-selling success, happy and profitable; short-selling failure, no need to be responsible. This kind of operation mode is a great profit, can it stand up to the study?

In addition, the mysterious organization has been mixed into the short-selling organization. The non-sunshine "cold gun" short-selling will not only target the enterprise, but also may bring other purposes. Who will supervise the mysterious short seller?

Two types of institutions are keen to attack Chinese companies

Among the short-selling institutions that frequently attack Chinese listed companies, drowning and toon are a type. Shannon was founded in 2001 and began to involve Chinese concept stocks in 2006. The company was first introduced in 2009, and founder Carson Bullock lived in Shanghai for a long time. The motivations and purposes of the two institutions are very clear, that is, short-selling profits, going straight to the theme - for money.

|

There is also a type of institution that is more mysterious, hacked, and has a political purpose, such as Anonymous Analytics. It is a branch called "Anonymous" hacking organization.

|

The Financial Times refers to the latter as a loose hacking organization: there is no formal list of members, and “anonymous people†join forces to engage in mischief, protests or various forms of non-violent resistance. The hacker organization attacked Sony, blackened the official website of North Korea, and smashed Kim Jong-un, and also made the CIA website a few hours long.

Unlike the toon and the drowning, the purpose and motivation of the anonymous analysis of shorting is more complicated. First, they have publicly stated that shorting is not for money. For example, when they were shorting Qihoo 360, they introduced themselves: "We are not short-selling institutions. Anonymous analysis does not directly or indirectly hold or bear all the securities mentioned in the report." But they concealed it, considering that The short positions held by its “joint parties, partners, member organizations, consultants, clients and other related parties†do not exclude the existence of some “indirect benefits†in the case of Qihoo 360. This plausible, unspeakable introduction and expression may be for a better real motivation.

Anonymous analysis of such institutions (if it is an institution) is more dangerous and uncontrollable than the business model of Shannon and Surabaya. When an institution claims that short-selling actions are not related to economic interests, any company that is shorted will shudder because this It has gone beyond the understanding of business.

Short-selling professionalism declines year by year

Toon and drowning, if you want to make money by making money, you have to have real materials. In recent years, the short-selling success rates of the two companies have become lower and lower, indicating that the situation is changing.

In the early days of short selling, some Chinese companies were unfamiliar with the supervision and disclosure rules of the mature financial system because of their lack of overseas experience. Especially for US investors, Chinese companies are mysterious. People are difficult or unwilling to verify the authenticity. American investors will naturally believe what the organization like Shannon said. The latter is using this information asymmetry to profit. .

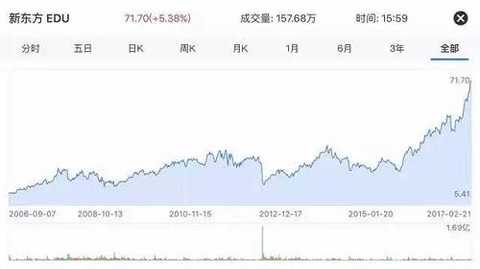

However, in recent years, Chinese companies have not only become harder and harder, but have also eaten more and more international financial rules. They no longer simply choose to avoid, but directly fight back. For example, both Shannon and Lishui have been short-selling in New Oriental, but New Oriental has all passed, and the stock price is like this:

|

Shannon shorted China Evergrande, Xu Jiayin directly returned to the roar. Look at the long-term trend of Evergrande's stock price:

|

The failure of short-selling occurred. First, the quality of Chinese enterprises has been greatly improved, the standardization has been continuously improved, and the ability of outstanding enterprises to resist malicious attacks has become stronger. Second, the public has been eccentric about the kind of speculative short-selling. The short-selling routine is a bit out of order.

Anonymous analysis is more dangerous

Anonymous analysis is more mysterious than toon and drowning, but mystery does not necessarily mean professionalism. It shorts Qihoo 360 and ends with a big defeat. The stock price of Qihoo is like this:

But both companies and regulators still have to pay enough attention to this organization. From the logo of the anonymous analysis, you can see that it is who you don't know, and the mysterious face is often seen. The institutions that dare not publish their true identity have three purposes: one is to create an atmosphere of horror and panic, and the bluff; the other is to break away from the laws and systems of the real society and exercise the super power without supervision; Human purpose, identity.

If you just pretend to be a mystery, or get some money with a short flag, it is still a trivial matter, but the reality is often not that simple. After this logo, it is a vain face, it can be a hiding scorpion of any power, used to attack any opponent that does not meet its values. Because in the eyes of these institutions, there are only their own value standards, and there is no world value standard. Of course, perhaps the value standard they claim to be is just an excuse for some kind of attack.

This kind of anonymous institution is not under the sun, nor under the supervision of various social systems. It can choose its own target in a dark corner, greedy the underground hand, it can claim to be a representative of justice, but who I can guarantee that this is not the "Dragon Legend" of the Myanmar version.

There is a dragon, each year asking the village to sacrifice a virgin. Every year, this village will have a young hero to fight with the dragon, but no life. Later, when another hero set off, someone quietly followed. The dragon's cave is covered with gold and silver treasures. The hero stabbed the dead dragon with a sword, then sat on the corpse, looked at the glittering jewels, slowly grew the scales, tails and tentacles, and eventually became a dragon. ("Looking for Orwell in Myanmar")

Financial security is national security

Shorting has a history of hundreds of years, and it is just a financial tool just like doing more. However, short selling has never been short-selling at no cost, nor is it a professional-free speculation, nor is it a lynching punishment without restraint and supervision. Powerful tools are within the rules and systems. This is a blessing to humanity, and when it is not in the hands of the regulator, it can help.

|

As a recent example, the world has been plagued by WannaCry ransomware recently. More than 100 countries and regions have been attacked, and many types of institutions, including hospitals, educational institutions, and government departments, have been attacked. The extortionists demanded the use of bitcoin to pay ransom. Otherwise, the precious materials of the infected institution will be destroyed. Bitcoin has recently been accepted by the Japanese government because it cannot be traced to become a representative of the new digital currency. However, its untrackable nature has become an accomplice to this global extortion. The world has lost billions of dollars, but it can never recover these losses. .

At present, the Chinese economy is at the bottom of the stage, and the days of enterprises are not good. In order to expand the market and develop space, China is fully promoting the strategy of going global, and has just held a grand summit of international cooperation in the Belt and Road. At this critical time, the anonymous analysis launched a short-selling action against Chinese overseas listed companies. The time was very sensitive and the motivation was more complicated. Considering the mysterious background of this organization, I have to be more guarded.

In the future, as Chinese companies and Chinese funds go out in large numbers, China must be vigilant and need to act immediately on these mysterious organizations that are above the existing legal rules. An organization that can arbitrarily darken the official website of a government, a body that claims to pursue "freedom and democracy," may turn its guns at any time and aim at China with unwarranted reasons.

With the gradual opening up of China's capital market, these mysterious institutions will gradually shift from short-selling US stocks and Hong Kong Chinese stocks to A-shares. The target of the attack may also be transferred from the listed company to the unlisted company, from the securities asset end to the monetary system end. The impact and losses will be much greater than the present, which is not just a small account of several listed companies, but a big account of financial security. It is necessary for China to include it in the scope of supervision from the perspective of financial security, at least to allow it to operate within the Chinese legal framework, and must not let these mysterious forces without knowing the background do whatever they want.

For national regulatory agencies, international regulatory consensus should also be formed, requiring short-sale institutions to be sunny. In this way, short-selling institutions and other financial institutions can compete in the same market environment, and allowing cold guns at no cost is a shame for global regulation.

As for all types of Chinese listed companies, they should also face all kinds of short and bearish in a calm and active manner. Even without the short-selling of these professional short-selling institutions, it is also possible to encounter a lower rating by the seller’s organization. The normal state.

What companies need to do is to operate the company itself and comply with the exchange's specifications. In the face of malicious short-selling attacks, we must be proactive in confrontation, and we must be good at using international laws and regulations to develop space for ourselves. Nothing doesn't provoke things, something is not afraid of things, every setback is an opportunity for growth. This is the path that any company must go through from small to big. (Finish)

Welcome more individuals, media and companies to cooperate with us, please contact WeChat:

Lx930525, indicate "public number ID + article + cooperation / reprint". @虎财富(laohucaifu) All rights reserved

Single Covered Yarn,Single Covered Spandex Socks,Spandex Covered Yarn,Spandex Air Covered Yarn

Shaoxing Shiffon Textile Co., Ltd , http://www.shiffontex.com