Friday (November 3) ushered in the last heavy event in the financial market "Super Week" - the US non-farm payrolls report. The US non-agricultural report, which is known as the “king of foreign exchange indicatorsâ€, may rebound sharply after the September report. Currently, the market expects non-agricultural growth to exceed 300,000 in October, and some experts even believe that non-agricultural growth is not ruled out. 400,000 possibilities. As in the previous month, the non-agricultural results tonight are also highly uncertain, coupled with the consistently large influence of non-agricultural data, so the financial market will usher in a night of “hurricaneâ€.

At 20:30 Beijing time on Friday (November 3), the US Department of Labor will release the unemployment rate in October and the non-agricultural employment data in October. Previously, the impact of the hurricane caused the United States to reduce 33,000 jobs in September, the first decline since 2010. The median forecast of economists surveyed by foreign media shows that jobs in October are expected to increase by 313,000 and the unemployment rate will remain at 4.2%.

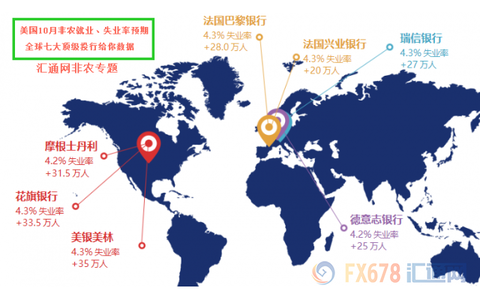

The following picture shows the expectations of the top seven investment banks in the world for non-agricultural and unemployment rates in the United States in October:

In the third quarter of 2017, the United States suffered the "most expensive" hurricane in history, and "Havi" and "Elma" caused an overall loss of $290 billion, equivalent to 1.5% of US GDP. Affected by this, non-agricultural fell in September, the first time in a decade, the employment population was negative, only -33,000 (that is, the number of employed people decreased by 33,000). Although the unemployment rate unexpectedly fell to 4.2%, the US dollar suffered a five-day losing streak. The impact of the hurricane caused the United States to reduce 33,000 jobs in September, the first decline since 2010.

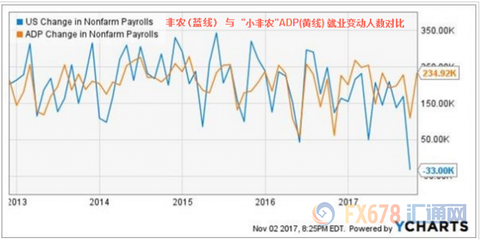

On Wednesday (November 1), as the most important non-farm prospective indicator, the ADP employment report showed that the number of ADP employment in the United States increased by 235,000 in October, the largest increase in seven months, indicating that the US job market is still strong. The data shows that the number of ADP employment in the United States increased by 235,000 in October, and is expected to increase by 200,000. The previous value was revised to increase by 111,000, and the initial value increased by 135,000. Although the ADP report is not necessarily an accurate forward-looking indicator of non-agricultural data, and sometimes even different from this data, it does help to provide useful guidance when used in conjunction with other employment-related data.

Data released on Thursday (November 2) showed that the number of jobless claims last week fell to nearly 44 years and a half, further evidence that the labor market is tightening. According to data released by the US Department of Labor on Thursday, after the seasonal adjustment, the number of US initial jobless claims fell by 5,000 to 229,000 in the week ending October 28, close to the 22-and-a-half-year low of 223,000 hit in mid-October. . This is the gap between the number of initial jobless claims and the strength of the job market below 30,000 in the 139th week, the longest since 1970.

Bloomberg wrote that traders continue to analyze the details of the tax reform plan, while shifting the focus to the US non-farm payrolls data to be released on Friday. Reuters wrote that the number of initial jobless claims is low, indicating a growth in non-agricultural employment in October. In September, jobs fell because of Hurricane Harvey and Irma, which caused some workers to temporarily lose their jobs. According to a Reuters survey, analysts expect Friday's data to show that non-agricultural jobs increased by 310,000 in October.

Forex.com senior market analyst James Chen wrote on Thursday: "Considering the performance of non-farm prospective indicators and the general expectation of non-agriculture in October is higher than 300,000, our target range is between 270,000 and 300,000, at 10 More than 300,000 jobs were added in the month. Any result beyond this range could bring a substantial boost to the dollar, which may help to sustain the recent recovery.†Chen pointed out that if the data falls within the range or Nearby, it is unlikely to have a big impact on the dollar. However, if the actual data is much lower than the target range, the dollar may have a sharp correction after the recent rebound.

Chen estimated how the results of different non-agricultural data affect the US dollar:

The increase is more than 320,000: very good dollar

The increase is 301,000-3.2 million: moderately good dollar

The increase is 270,000-300,000: neutral

An increase of 240,000 to 269,000: a moderately weak dollar

The increase is less than 240,000: bad dollar

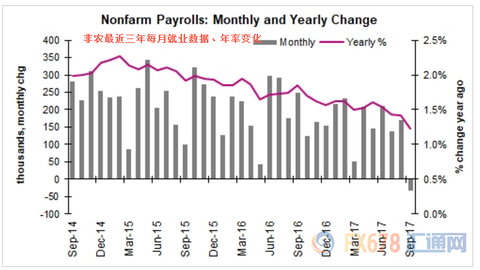

The following chart is a summary of historical data on US non-agricultural employment changes over the past three years:

Bloomberg economists wrote last weekend that, just as the employment data in September was affected by the weather, the October data would be the same, but it was the opposite. The increase in employment in October will be at least equal to the decline in September, as affected individuals return to work. Reconstruction work may further increase the data. The article pointed out that Bloomberg Economic Research estimated that the number of non-agricultural employment increased by 355,000, higher than the market expectation of an increase of 310,000. Given that the number of non-agricultural employment fell by 33,000 in September, it is not impossible to increase the number of new people to 400,000 in October.

Investors will also focus on data on payroll. If non-agricultural reports show that wage growth is sustained, the reasons for raising interest rates will be strengthened, as high wages will affect core inflation. Last month, the average annual hourly wage rate in the United States jumped to 2.9%, the highest in the past three years, but it still exists: because of the hurricane, many low-income workers in restaurants and bars in the United States are temporarily unemployed, and the overall average hourly wage will be Was pushed up. The average monthly hourly wage rate in the United States is expected to rise by 0.2% in October, up from 0.5% last month. The average hourly wage rate in October is expected to rise by 2.7%, compared with a 2.9% increase last month.

The following chart is a comparison of US non-agricultural and “small non-agricultural†ADP employment changes:

★ Non-agricultural five major points of view, 360 degrees without dead angle prospects

Before the release of non-agricultural data tonight, the "Wall Street Journal" currently lists the top five highlights to help investors better judge the US employment situation:

1. Will the number of new non-agricultural employment rebound sharply? In September, the number of non-agricultural employment in the United States unexpectedly decreased by 33,000, the first decline in seven years, and the longest employment growth record in the history of the United States was suspended. However, the unemployment rate unexpectedly fell to 4.2% in September, setting a low level in nearly 17 years. Currently, economists expect jobs to increase by 315,000 in October, which is expected to hit the biggest increase in two years, while the unemployment rate is expected to remain at 4.2%. Goldman Sachs is boldly expecting the US non-farm payrolls to increase by 340,000 in October.

Second, focus on September data revisions and average new employment within three months: Analysts warned that October and September data may be hit by Hurricane Harvey and Elma and mountain fires in northern Canada Seriously distorted, and these natural disasters may continue to affect data for the coming months. Weather-sensitive industries such as entertainment, hospitality, construction, and mining can be particularly affected, so data can fluctuate more. The Labor Department had estimated that only 8% of US urban and rural workers were affected by the hurricane, but the impact of the storm on September nonfarm data far exceeded the expectations of economists. Therefore, investors should pay attention to the revised value of the September data, and pay close attention to the average new employment within three months, in order to better judge the US employment situation.

Third, the salary data is still the focus: the average hourly rate in September was 2.9%, the best performance since the end of the 2009 recession. If the salary growth rate in October is still close to this level, it indicates that the strong job market has finally begun to drive wages. In addition, the unemployment rate in September was 4.2%, the lowest since 2001. If the salary keeps rising in this situation, it will be good news for the Fed, which has been predicting that the labor market will eventually increase inflation. If the report shows that wage growth is sustained, it will certainly strengthen the reasons for raising interest rates because high wages will affect core inflation. The current market expects the average monthly hourly rate to rise by 0.2% in October, down from 0.45% in September. As the September data may be affected by the hurricane, many low-income workers in restaurants and bars are temporarily unemployed, and the overall average hourly salary will be Therefore it is pushed up.

Fourth, the industry sub-data is equally important: in the non-agricultural report in September, the entertainment and hospitality industries were most affected by the hurricane, and these industries reduced a total of 111,000 jobs. It is expected that in October data, new jobs in bars and restaurants may compensate for these losses. The construction industry is also expected to record employment growth, as maintenance demand has increased significantly after the hurricane. At the same time, the transportation and warehousing industries associated with the construction industry are also likely to create new jobs. In the current tight job market, the phenomenon of competition for workers in the above industries may also help to push up wages.

5. The long-term employment trend is still gratifying: the data noise caused by the hurricane will affect investors' correct interpretation of the US recruitment situation. However, current consumer and corporate spending is strong, and the latest indicators indicate that the US economy remains stable after entering the last quarter of 2017. Low unemployment, rising wages, and the US stock market and house prices, which have been growing strongly in recent months, continue to boost consumer optimism and stimulate US households to increase spending. These momentums are likely to continue in October. The University of Michigan Consumer Confidence Index has hit its highest level since 2004 in October, and sales of major automakers were also quite strong last month. Under these trends, companies are expected to maintain their willingness to recruit.

★ "Numbers" non-agricultural: forward-looking data collection

Focus indicator: US non-farm payrolls report for October;

Announcement time: 20:30 tonight, next week after the US winter time, non-agricultural postponement will be postponed until 21:30, cherish the last "early non-agricultural" in the year;

Market expectation: +313,000 (including private enterprise employment expected to increase by 302,000) VS previous value -33,000 for seven years (since 2010) is the worst;

Non-agricultural maximum expectations: +400,000; VS minimum expected: 122,000;

Non-agricultural standard deviation: 46,300; VS non-agricultural six-month average: 139,000;

Unemployment rate is expected: 4.2% vs. 4.2%

Labor participation rate before the value: 63.1%

Average hourly rate per annum expectation: +2.7% VS previous value +2.9%

Average weekly working hours expected: 34.4 VS before value 34.4

ADP employment situation: an increase of 235,000 in October, expected +2 million, the previous value of 135,000

ISM manufacturing employment sub-item: October reading 59.8 VS previous value 60.3

The average weekly value of initial jobless benefits: 232,500 VS September non-agricultural corresponding data 268,200

October Challenger layoffs: 2.9831 million VS before the value of 32.346 million

★ Non-agricultural data and Fed rate hike prospects

The hurricane may blow up more non-agricultural employment in the United States in October, and watch the market expect the Fed to accelerate its pace. Beijing time on November 3 at 20:30 will be released in October US non-agricultural employment data; this non-agricultural employment population change data is expected to rebound sharply, consolidate the confidence of the Fed tightening policy, as follows:

Bloomberg expects US jobs to increase by 313,000 in October, and Reuters expects to add 31.0 million, which is quite optimistic compared to the previous month's reduction of 33,000.

The reason for the expected optimism was the impact of Hurricane Harvey and Elma; the two hurricanes hit parts of Texas and Florida in late August and early September, causing many workers to be temporarily unemployed. After the hurricane in October subsided, large-scale employment recovery is expected; In addition, the cleanup and reconstruction work after the windstorm is expected to greatly boost the employment in the construction industry in October;

According to information released by previous Fed officials, the United States currently expects to increase the number of employed people by more than 12-15 million per month, and the Fed will not slow down the existing policy path;

And if employment increases sharply, changing the hurricane-related decline in September, and then the Fed will raise interest rates in December, even if wage growth may slow down.

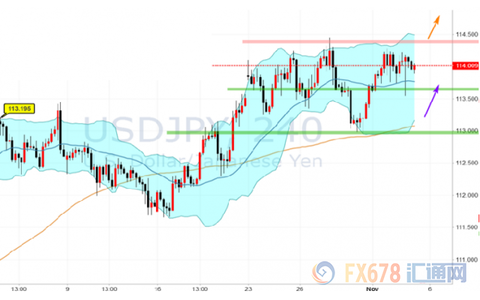

★Do non-agricultural market, first understand the technical side

Japan is closed for holidays, which makes the gold market weak. Before the US announced the October non-farm payrolls report, investors maintained a cautious attitude as usual. Spot gold is likely to record the first weekly gain in three weeks, and the gold price hit a two-week high of $1284.23 on the last trading day. The world's largest gold exchange-traded fund (ETF), the SPDR Gold Trust, said its gold holdings fell 0.42% to 846.04 tons on Thursday.

National Australia Bank analyst John Sharma said: "The price of gold seems to be roughly flat. Powell's decision to take over as chairman of the Federal Reserve is generally in line with expectations, and the market is waiting for US non-farm employment data. If the data is strong, it will not benefit the price of gold."

Technically, spot gold is neutral in a narrow range of $1263-1281 per ounce. If it breaks through the range, it may show a trend. The above range consists of 61.8% and 50% retracements from $1204.45 to $1357.54. The price of gold failed to break through $1,281 on Thursday (November 2), and it is doubtful whether it will try to overcome this obstacle again. As shown below:

A detailed analysis of the rebound from the low of $1,263.35, which began on October 27, shows that this wave can be divided into three small waves. The third wave c wave is roughly equivalent to the first wave a wave. This structure indicates that the rebound trend is complete. If the price of gold rises above $1,811, it will open the channel to $1,299. If it falls below $1,263, it may drop to $1,241. As shown below:

[Golden GOLD technical and non-agricultural operation strategy] On the daily chart, the price of gold is in the ascending channel, and currently touches the important support of 1263-1267 on the lower rail. If there is a favorable momentum in the shock, we still have to pay attention to 1263- 1267 support, if it can not effectively fall below. We can't make a big short. Of course, above, we use the golden section and high point analysis method to analyze, 1284-1281 is a major resistance. If it can't break through, the price can't be sustained, so it is inevitable to go short. From the 4-hour chart, there is a very obvious low point of 1263 to a low of 1268 and a high of 1276 to 1280. The current gold consolidation fluctuates between 1281 and 1272, and has already smashed 11 K-lines. That is 44 hours, with the shocking trend close to the upward trend line, it is expected that the gold fluctuations will not be large before the large non-agricultural data, waiting for the large non-agricultural layout in the evening! ! Therefore, tonight, the non-farm pays more gold price, does not break through 1284, then we short near 1284, with stop loss, if the data profit breaks through 1284, then the multi-head space opens, we see 1289-1294, if the data is bad price before the data Close to 1284 blocked, we are afraid of it, if the data is negative, the price fell to 1263-1267, but do not fall below the support, then we can not short. If the negatives fall below 1263-1267, then there is still room for the short position. If the market data, contrary to the price trend, we can still analyze the 1263-1267-1284 support or resistance level to make a layout list! In this way, we can do it, we can do it, we can defend it! However, it should be reminded that each order sets 2-4 point stop loss according to our own ability, and the position is below 30%! This is the iron law!

[Silver SILVER technical and non-agricultural analysis] Silver from the daily chart, yesterday's daily line received the Yin cross star, still supported by the Bollinger belt mid-track support, from the indicators point of view, Bollinger bandage, RSI central walk Ping, the Stoch indicator is currently running at a high level, indicating that the short-term silver line will once again face the choice, but from the big Yang line on Wednesday, the probability of favoring the bulls is large, and the evening focuses on the data of the large non-farm; from the 4-hour chart, the silver High-level shocks, ready to meet the big data in the evening, from the indicators point of view, the RSI running high has signs of turning heads down, Stoch indicator running low, the probability of index bias rebound is large, from the 1 hour chart, silver is still in the interval 17 to 17.23 interval volatility, before the large non-agricultural data is expected, there will be no big market. From the indicators point of view, the RSI high head is down, the Stoch indicator is running low, the probability of the index biasing is large, and the above-mentioned top concerns the 17.3 and 17.5 line pressures. Position, below the attention of the 17 first-line support, the operation is still dominated.

[Cold crude oil OIL technical and non-agricultural analysis] Crude oil from the daily chart, yesterday's crude oil down 54 54-line integer gateway platform stabilized and closed, forming a bullish engulfed K-line pattern, crude oil short-term bias continues to rise pattern, the top focus During the year, the pressure of the 55.3 line will be closed. Once this position is broken, the crude oil will directly attack the 62 line. From the indicator point of view, the RSI is at a high level, the Stoch indicator is running at a high level, there is adjustment demand, and the operation is still low. From the 4-hour chart, the low point rises and the bullish trend of the high point is unchanged. The current price is running near the gate in the year. Before the break, we operate according to the interval 55 to 54. From the general perspective, it is still bullish. According to the indicators, the RSI is at a high level, the Stoch indicator is high, and the indicator is biased. The adjustment is continued. The above-mentioned focus is on the 55.2 and 55.9 first-line pressure levels. 54.1 and 53.4 first-line support.

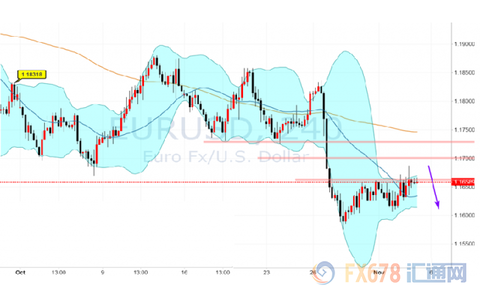

[Euro-US dollar EURUSD technical analysis] On Thursday, Europe and the United States on the daily chart on the small Yangxian line, this week, out of the small-line type of ups and downs, is a form of callback market, since the European Central Bank's interest rate decision last Thursday, the euro fell sharply, Europe and the United States have been adjusted for nearly a week. On the 4H chart, the exchange rate is slowly rising. This round of decline may be adjusted. We have emphasized this week. The current exchange rate fluctuates around the weekly pivot axis and the weekly cost line of 1.1660. The next position is in the fibo50% and the integer level 1.1700. The common retracement level, the US announced the non-agricultural employment data today, paying attention to whether the data can end the adjustment of Europe and the United States, returning to the main trend of decline requires investors to pay close attention, although the decline in Europe and the United States, although slow, but has a single investment People should not miss the next round of declines due to long-term adjustments, and be wary of the two-way fluctuations caused by the data market.

[Australian dollar against the US dollar AUDUSD technical analysis] Yesterday, Australia and the United States closed the Xiaoyang line, the decline above 0.76 has stopped, the big level does not rule out the possibility of opening up the trend, Australia and the United States we also waited for nearly a week, 4H map, already Going out of the low point and higher point, the higher Dow reverse, but this is only a small level of reversal. Whether it can be converted into a large level of reversal requires continuous attention, especially yesterday's high of 0.7720/30. Doing more than Australia and the United States before the break is a test, and it is necessary to strictly control the position, especially today may bring the dollar stronger. Among the commodity currencies, we hold more orders for the New Zealand dollar against the Australian dollar and the euro, which can continue to be held. The New Zealand dollar is stronger in the non-US, and the New Zealand direct market also has signs of reversal, vigilant against the impact of non-agriculture on the direct market. .

★ bullish dollar, so analysis

The ADP data and the non-agricultural market are about 80% of the same-sex probability, so we know that the probability of bad interest tonight is still very large. Secondly, we look at non-agricultural data, the former value is -33,000, and the expected value is 310,000. Last month was so bad, this month suddenly expected so good, then the probability of this month is more than 310,000? Suddenly such a big jump, the possibility is big, certainly not big, but ADP employment data, we will see, the previous value of 13.5, the expected 20, the published value of 23.5, the data, it is true that this month is better than the employment situation last month, Then the expected value is greater than the previous value may still be large!

As far as market trends are concerned, some insiders pointed out that the actual results are easily disappointing because of the high expectations of the overall employment data. However, even if the data is lower than expected (which is clearly high), any negative impact on the dollar may be limited. Conversely, if the actual data is in line with expectations, which will help support the Fed's current policy path for higher interest rates, then the dollar may be positively affected. In this case, the current rebound in the US dollar is likely to expand further.

★ Look down on the dollar, say so

A strange phenomenon in the last non-agricultural report was that the number of initial jobless claims increased and the unemployment rate would pick up; but the actual data was blunt, and the unemployment rate fell directly from 4.4% to 4.2% in September. At the beginning of October, the data will fall back to the annual low again. The unemployment rate should maintain a low of 4.2% in October. However, if there is an accident, it will slightly rise to the previous value of 4.4%, and the US dollar will fall in real terms.

On the whole, in the employment data, due to the large amount of water in the “post-hurricane eraâ€, the non-agricultural employment data and the unemployment rate are likely to be difficult to meet market expectations. The over-representation of major institutions is obviously too optimistic. If so, The dollar will have a negative impact; even if the data is close to expectations, this is a general psychology of the market. The dollar is not large, and it is easy to appear like the reverse trend of the pound yesterday: the data is bullish. Please be cautious. Correspondingly, the price of gold may rise.

The ADP (small non-agricultural) announced on Wednesday was unusually beautiful, with a value of 235,000, which was significantly higher than the previous two months and the expected value of 200,000. But the market did not buy it, and the performance was dull. According to industry breakdown data, there is actually a large amount of water in the 235,000 data: the number of new employment in the construction industry has increased by 62,000, the largest increase since February 2006 (previous value was only 19,000). The surge in employment in the construction industry is mainly due to the need to rebuild after the hurricane. For the short-term factor, the ADP data is only about 190,000, which is actually lower than the previous average. This is not difficult to explain why the data surface is bullish. The dollar is not the reason for the move.

From another point of view, even according to the ADP data level of 235,000, it is only equal to May and August, and the corresponding non-agricultural employment population data is 138,000 and 156,000 respectively. However, the market expects an average of 310,000, which is far more than twice the previous value. Therefore, boldly predicting, this data is difficult to achieve the expected value, even if the "accident" is reached, the water is difficult to make the market excited! The probability of a bad dollar is greater.

(Editor: HN666)

NANTONG MASTERPIECE TRADE CO.,LTD , https://www.yuaccessory.com